Over the last year holidays have been majorly scaled back, and we’ve instead indulged in more simple and local pleasures. But, those big ‘bucket list’ yearnings are hard to let go of aren’t they?

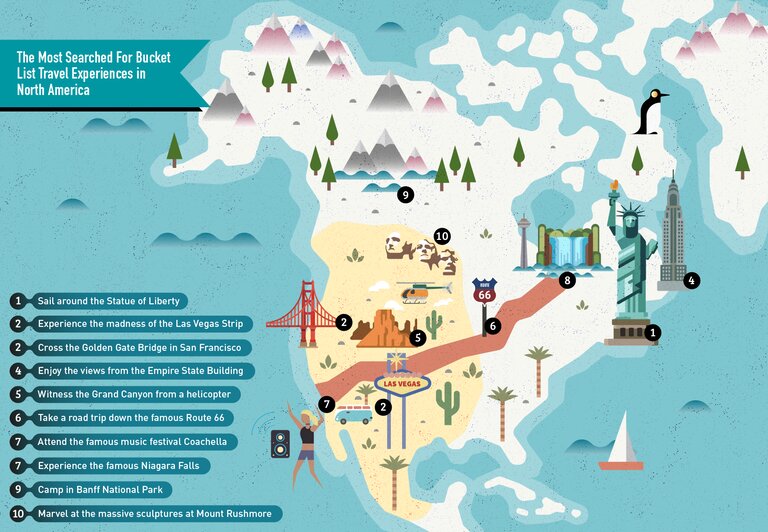

A year of travel bans has only fuelled our wanderlust: the thought of Angkor Wat, Banff National Park and the Great Barrier Reef is more enticing than ever.

If a year at home has taught people anything about travel, it is to stop putting off those big, once-in-a-lifetime trips.

And with travel starting to open up, it got us thinking. When people are free to travel wherever, whenever, where in the world do they actually want to go?

The team at Unforgettable Travel have found out exactly that. We used global search data to track which bucket list experiences we’ve all been searching for, and therefore can reveal where in the world people are yearning to discover the most…

The 50 Most Searched For Bucket List Travel Experiences

Between them, the top 50 bucket list travel experiences have an average of almost 175,000 global searches each month. And the most searched for? The tallest building in the world.

That’s right. The most searched for bucket list travel experience is a trip to the top of the Burj Khalifa in Dubai. Being able to host up to 35,000 people at once, the world’s tallest freestanding structure is often referred to as a Vertical City. And with 10,000 searches a month for ‘Burj Khalifa tickets’, people are certainly keen to explore its 160 storeys.

So without further ado, these are the top 50 most searched for bucket list travel experiences in the world…

!function(){“use strict”;window.addEventListener(“message”,(function(e){if(void 0!==e.data[“datawrapper-height”]){var t=document.querySelectorAll(“iframe”);for(var a in e.data[“datawrapper-height”])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data[“datawrapper-height”][a]+”px”}}}))}();

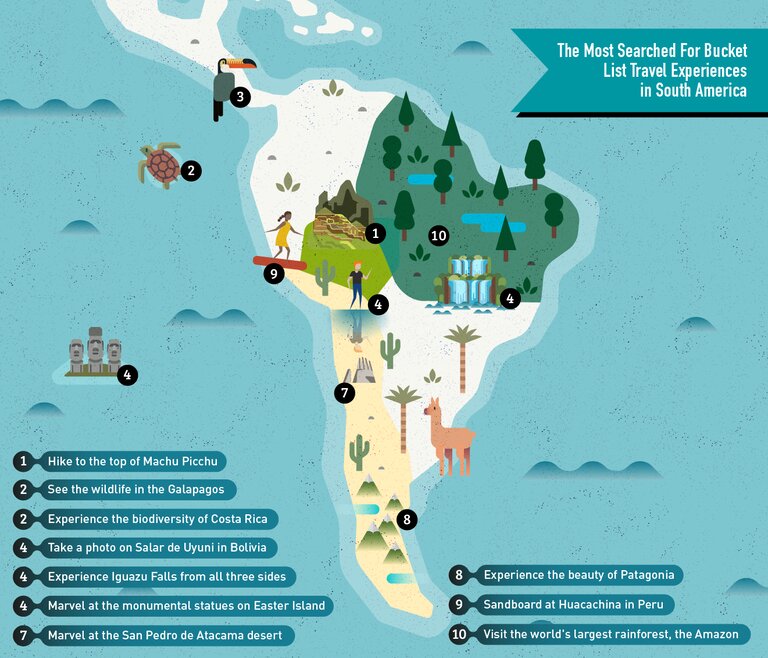

After a year of being cooped up inside, people are yearning for the great outdoors, with six challenging hikes featuring in the top 50 list: Everest Base Camp, Machu Picchu, Mount Kilimanjaro, Havasu Falls, Trolltunga and Table Mountain.

And when it comes to the location, Europe features heavily in the list, securing 19 out of the 50 top spots and across a range of experiences including art, history, adventure and even partying!

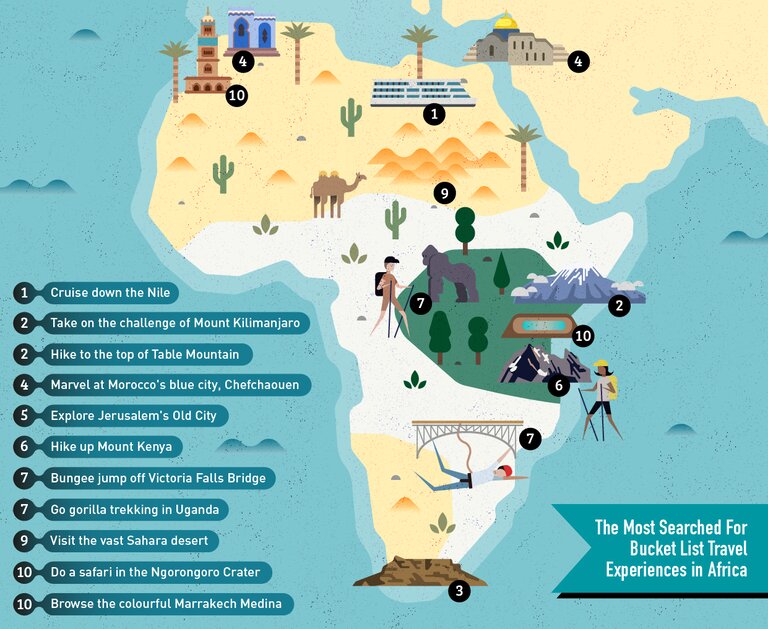

So that got us thinking again, what are the ten most popular bucket list travel experiences in each continent?