-

A Guide to Andalucia

With some of Spain’s most varied-terrains, Andalucia is one of the most spectacular parts of the country, including everything from fertile plains to forest-covered alpine mountains.…

-

The Ultimate Guide To Douro River Cruises

From the cosmopolitan cities of Porto and Salamanca to the tiny, historic villages of Castelo Rodrigo and Marialva, Douro river cruises offer stress-free sightseeing in…

-

Alternative Summer Destinations in Europe

Summer is the most popular time for traveling, which means many flock to top destinations in the Mediterranean like Santorini, Marseille, and Barcelona. That can…

-

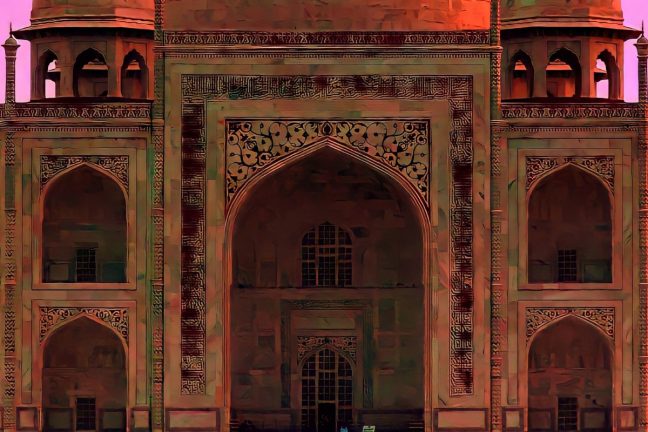

Best Historical Sites in the World

From the Egyptian pyramids to Cambodia’s Angkor Wat, the world has a wealth of fascinating historical sites that date back thousands of years, remnants of…

-

The 10 Best Things to Do in Mallorca

Surrounded by turquoise waters, dotted with historic settlements, and home to some of the most beautiful natural landscapes in the Mediterranean, the island of Mallorca…

-

The 10 Best Things to Do in San Sebastian, Spain

The city of San Sebastian in Spain, known officially as Donostia, is located in the Basque region in the north of the country. Home to…

COPYRIGHT © 2024 UNFORGETTABLE TRAVEL. ALL RIGHTS RESERVED