-

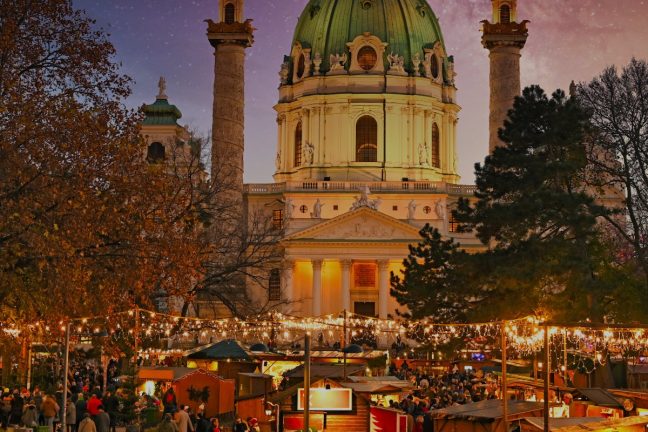

Best Christmas Markets in Europe

Gingerbread, spiced mulled wine, the sweet songs of choirs: it's no wonder many travel to Europe just to enjoy its Christmas markets. For those who…

-

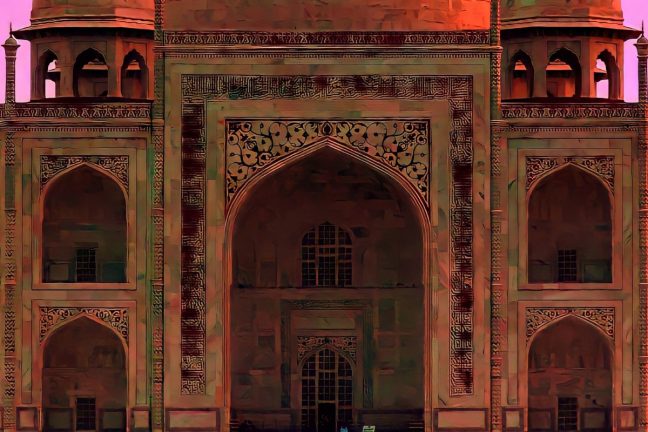

Best Historical Sites in the World

From the Egyptian pyramids to Cambodia’s Angkor Wat, the world has a wealth of fascinating historical sites that date back thousands of years, remnants of…

-

Best Time to Visit Poland

While Poland has a ton to offer from fascinating history to spectacular nature, it’s obviously not a tropical destination known for its sunshine. Knowing when…

COPYRIGHT © 2024 UNFORGETTABLE TRAVEL. ALL RIGHTS RESERVED