-

Top Bucket List Destinations

The world has so many spectacular destinations, but there are some that you simply must add to your bucket list, offering experiences that can’t be…

-

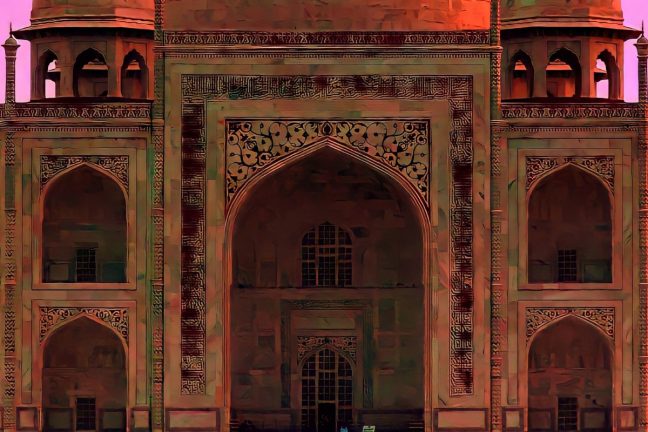

Best Historical Sites in the World

From the Egyptian pyramids to Cambodia’s Angkor Wat, the world has a wealth of fascinating historical sites that date back thousands of years, remnants of…

COPYRIGHT © 2024 UNFORGETTABLE TRAVEL. ALL RIGHTS RESERVED