-

The Ultimate Guide To Mekong River Cruises

You may consider the Mekong River a large waterway passing through tranquil, rural scenery. But, as this mighty river flows towards the ocean in southern…

-

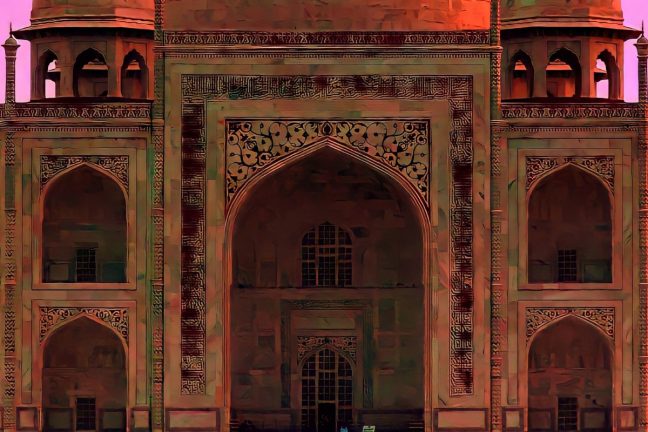

Best Historical Sites in the World

From the Egyptian pyramids to Cambodia’s Angkor Wat, the world has a wealth of fascinating historical sites that date back thousands of years, remnants of…

-

Unique Stays

Since our conception, we have lived by our strapline – why do ordinary. Every trip we send our clients on has to be extraordinary. Each…

-

Putting People Back Into Travel

-

Best Time to Visit Cambodia

-

Things to Do in Cambodia

Enchanting Cambodia is most famous for its magnificent, UNESCO World Heritage Site of Angkor. The charismatic capital of Phnom Penh with its world-class restaurants. Siem…

COPYRIGHT © 2024 UNFORGETTABLE TRAVEL. ALL RIGHTS RESERVED