Meet our Editor

Although our editor, Gemma D’Souza, was born and raised in the UK, she has traveled extensively across the world. With Indian and Scottish roots, Gemma has always been surrounded by interesting culture and colorful traditions which was the catalyst for her love of travel.

Gemma has spent her professional career bringing ideas to life through imaginative content creation. She founded a safari magazine in 2019 and made a name for herself in the Africa travel industry. In doing so, she has become enthralled in the stories and experiences of local people around the world. Although a destination is the focus of a trip, she believes that the people – who you are with, and who you meet along the way – are the things that make your trip that extra bit special.

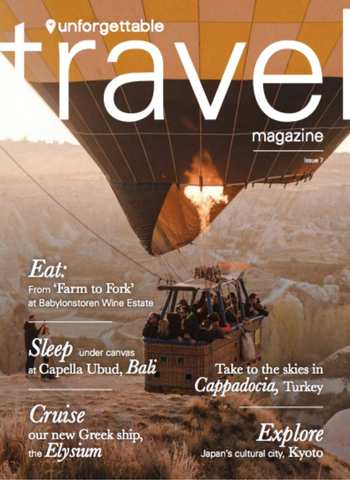

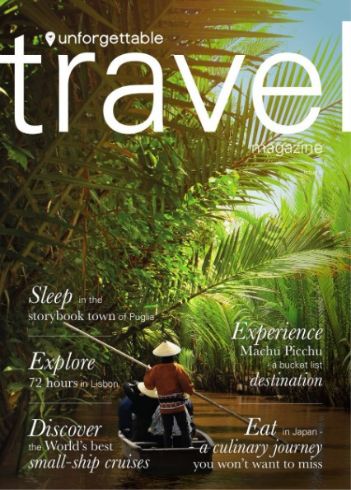

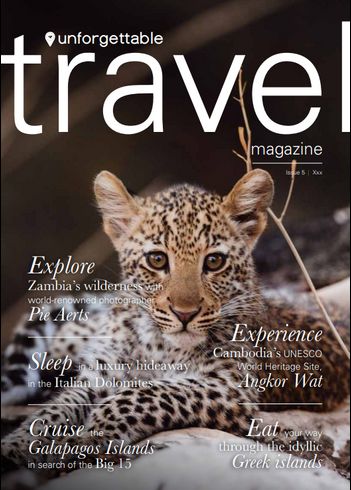

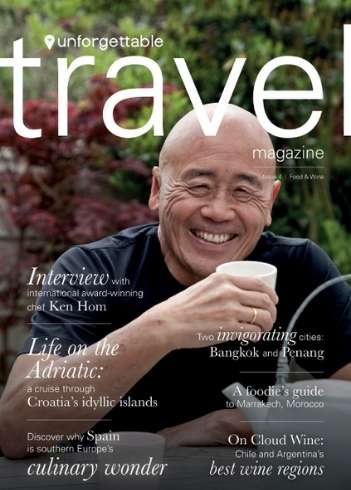

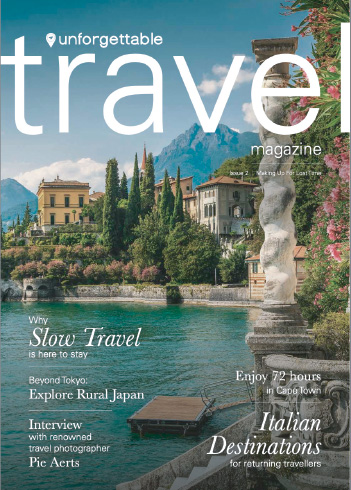

As Editor of our Unforgettable Travel Magazine, Gemma is part of the team that brainstorms ideas, research destinations, and write feature pieces for each issue. Whether it’s a luxury beach retreat in the Maldives, a romantic city break in Italy, or a family adventure to Costa Rica, our magazine will uncover exciting destinations and stories to dive into.

There is something about safari life that makes you feel as if you had drunk half a bottle of champagne – bubbling over with heartfelt gratitude for being alive

Karen Blixen, Danish author

Q&A with Gemma

What led you to become editor of Unforgettable Travel Magazine?

I’ve always been a writer, a reader, and a bit of a dreamer. When it comes to anything – travel, sport, beauty, fashion, and nature to name a few – I always turn to magazines and books for education and inspiration. I have worked in many content-focused and editorial roles but, with such a huge passion for travel, it’s always been a goal of mine to work as a travel editor. The beauty of working with a team of travel writers and experts is there is never a shortage of ideas. Our weekly meetings are always fueled by inspiration, weird and wonderful suggestions, and never-ending supply of flat whites.

What is integral to a good travel magazine?

Innovation and adaption. We saw the face of travel dramatically change in 2020, and something that is key to a great travel company and magazine is the ability to adapt. Unfortunately, travel was made impossible for most of us in 2020, but for dreamers like me and you, the desire to travel never stopped during 2020. Travel magazines, including ours, became more even more inspirational, and gave us destinations for us to consider for the future.

Where is the strangest place you’ve been to?

Although the word ‘strange’ can be interpreted in so many ways, I personally think of the place that I have had the most unusual experiences in. For me, that place is Tokyo. I took a train from the airport to Shinjuku station – a train station that has 200 exits. In a state of confusion, I rushed to the bathrooms to freshen up, to which I was confronted with a minefield of buttons and settings for the toilet. A ‘Princess Button’ is even featured, which plays lovely music. This was designed because, apparently, too many women flush in excess just to hide certain noises. The few weeks I spent in Tokyo were full of wonderfully strange experiences – robot restaurants, bars that wouldn’t let you in unless you sing a song on karaoke and seeing cats on skateboards being walked through temples being just a few.

Which is your favorite hotel in the world?

If it was down to the most memorable, then I’d go with the Ice Hotel in Sweden. That said, I am staying in Giraffe Manor in Kenya next year so that may top it. If it was down to the hotel that I would revisit, I would say Lamai Camp in the northern Serengeti, Tanzania or Chinzomno in the South Luangwa National Park, Zambia.

Where is the most inspiring place you’ve been to?

In travel, I am inspired by two things. The first is people – in particular, their local traditions and the way they live with one another is what I find most fascinating. I enjoy visiting local and remote tribes because there is so much to be learnt from them. Take the San Bushmen for example. As indigenous people of Southern Africa, they have spent thousands of years perfecting the art of hunting and gathering. They track on foot with a bow and arrow through the Kalahari. Fitness is something that comes naturally to them. A visit to see how the San Bushmen live and hunt inspired me to change and adapt certain practices in my life. Ok – so I didn’t go home and hunt for my food in the UK. However, I was inspired by their lack of food wastage. Because tribes like the San Bushmen hunt for their food, nothing is wasted and everything is appreciated, which is far more than I can say for the way that many of us live here in the UK – myself included. Image credit: Wilderness

The other thing that inspires me the most is nature. Nature has a solution to everything, and my interview with luxury car designer, Frank Stephenson, is a great example of this. Here, he states “nature is all about survival, so things are designed to work as well as they can, or adapt, for the longevity. So if you take inspiration from nature, you are bound to end up with something that looks good for a long period of time.” Read the full interview with Frank Stephenson in issue 3 of Unforgettable Travel Magazine.

Where is the most remote place you’ve been to?

I’m always on the hunt for remote destinations. Although I love a city break – Madrid, Kuala Lumpur, Rome, Paris, San Francisco being some of my favorites – for me, nothing beats traveling to the middle of nowhere to feel you have the ‘world to yourself’. Three places I have been to come to mind when I think of this question. The first is the temples of Bagan in Myanmar. Here, you are surrounded by hundreds of ancient temples with only a handful of people to share them with. Secondly, the northern tip of Sweden. In fact, northern Scandinavia is very untouched and there is something very charming (and cold) about it. Finally, the last remote destination I enjoy traveling to is the Scottish Highlands. The family on my mothers’ side are from Scotland so I’m fortunate to have a base up there, with forests to walk through and mountains to hike up.

Safe travels!

Editor Letters

Read our latest edition

READ MORECOPYRIGHT © 2024 UNFORGETTABLE TRAVEL. ALL RIGHTS RESERVED