Highlights of Egypt

- Duration7 Nights

- StylePrivate Tour

- When to GoApr - Oct

- Price GuideFrom £4,000 Per Person

At a Glance

Cairo

- Private airport transfer to your hotel in Cairo

- Private Tour City including the Pyramids of Giza, the Sphinx, and Cairo’s Egyptian Museum

- Private Tour of Mempis, Sakkara & Dahshur including the Pyramid of Djoser & the Red Pyramid

Luxor

- Private Transfer from your Cairo Hotel to Cairo Airport

- Flight from Cairo to Luxor with private transfer to your hotel on arrival

- Private Tour of Luxor's East Bank including Karnak's temples

- Private Valley of the Kings Tour including Temple of Queen Hatshepsut & Colossi of Memnon

Aswan

- Private transfer from your Luxor Hotel to your Aswan Hotel

- Private Tour of Aswan including the High Dam, Unfinished Obelisk & Philae Temple

- OPTIONAL: Private Tour of the Abu Simbel Temple Complex by air or by land

- Private transfer to Aswan Airport for your onward flight

Meet Our Expert

Luke

Egypt Specialist

I firmly believe that Egypt’s epic history and colorful contemporary culture make it one of the world’s greatest bucket list destinations. Talk to me today about Cairo’s bazaars, astonishing Nile cruises, and magical Red Sea diving.

What’s Included

- 7 nights in 4 or 5-star accommodation

- Daily breakfast at all hotels

- All mentioned airport transfers and road transport on a private basis in Air Conditioned vehicles

- All mentioned tours and sightseeing on a private basis with an English-speaking private driver / guide

- Entrance fees for any mentioned sightseeing, permits, local taxes, etc

- All mentioned regional flights in economy class, inclusive minimum 20kg per person checked baggage

- 24/7 support from our dedicated staff

- Flexible, personalized itinerary based on your interests

What's not Included

- International flights from your country of origin

- Tips or gratuities to guides, drivers, hotel staff

- Any meals, tours, or activities other than those specifically mentioned in itinerary

- Any tours advised as 'Optional' on the itinerary

- Incidental local expenses - souvenirs, laundry, taxis, etc

- Visas for Egypt. Your consultant will advise of any required visas and how to obtain them.

- Travel insurance - we strongly recommend you purchase travel insurance as soon as you have booked your trip.

Day by Day Itinerary

- Day 1

Cairo Arrival

Your Highlights of Egypt trip begins with your arrival at Cairo airport. You’ll be welcomed by a representative who will be at your arrival gate to assist you with passport control formalities and your luggage before providing a transfer to your hotel. Due to traffic congestion, this can take a while. Enjoy the time to relax while someone else does the driving. After checking into your hotel, you’ll have the remainder of the day to yourself. As many flights arrive at midday, you probably won’t have time for sightseeing, but you might enjoy the pool before enjoying a meal at one of the restaurants on-site.

- Day 2

Cairo: Pyramids, Sphinx & Egyptian Museum

You have a full day ahead, so you’ll want to enjoy breakfast at your hotel before meeting with your private driver/guide for a tour that visits the incredible Pyramids of Giza, the Sphinx, and Cairo’s Egyptian Museum. You’ll get to witness the iconic Great Pyramid that’s managed to survive for over 4,600 years along with the other two impressive pyramids and the world’s oldest known monumental sculpture, the Great Sphinx that guards them. Afterward, you’ll travel into the city for a visit to the Egyptian Museum which contains the largest collection of Egyptian artifacts on Earth, including the golden sarcophagi of Tutankhamun.

- Day 3

Cairo: Memphis, Sakkara & Dahshur

Another full-day tour with your private driver/guide, after breakfast you’ll get to explore some of the lesser-known fascinating places in the region: Memphis, the former capital of ancient Egypt, the Pyramid of Djoser at Sakkara, and the Red Pyramid at Dahshur. In Memphis City, which dates back to 3100 BC you’ll see the colossal statue of Ramses II and the great Alabaster Sphinx, while Sakkara’s pyramid is considered a key part of the progression of pyramid evolution. The Red Pyramid, also known as the North Pyramid, is the largest of the pyramids in Dahshur, a royal necropolis on the West Bank of the Nile.

- Day 4

Luxor: East Bank, Luxor & Karnak Temples

After breakfast this morning, you’ll take a private transfer back to Cairo’s airport to catch your flight to Luxor. Upon arrival, you’ll be met by another driver for a private transfer to your hotel. Take time to settle in and then look forward to a tour of Luxor’s East Bank that includes Luxor Temple which dates from 1392 to 1213 BC, and the Temple of Karnak, dating from 2055 BC to around 100 AD. Discover architecture and art stretching from the Middle Kingdom to the Ptolemaic dynasty, including massive obelisks, the avenue of sphinxes, and the towering carved pillars in Karnak’s hypostyle hall.

- Day 5

Luxor: Valley of the Kings, Temple of Queen Hatshepsut & Colossi of Memnon

Another exciting tour awaits with your private guide bringing you on a journey to the West Bank of the Nile to visit the Valley of the Kings after breakfast. This was a royal burial ground for pharaohs from around the 16th to the 10th century BC, including Tutankhamun and Ramses II. You’ll also see the terraced temple of Queen Hatshepsut, built to commemorate the great queen’s achievements as well as being her funerary temple and a sanctuary for the god Amon Ra. Marvel at the two huge stone statues at the front of the Theban Necropolis’ largest temple known as the Colossi of Memnon as well.

- Day 6

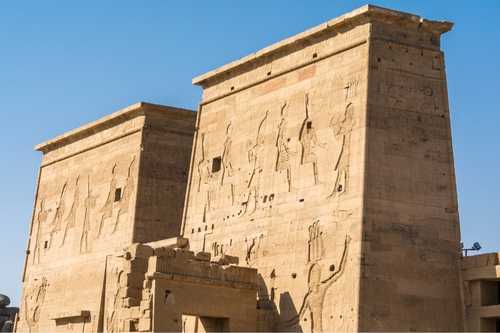

Aswan: High Dam, Unfinished Obelisk & Philae Temple

Enjoy breakfast at your hotel taking a private transfer to your hotel in Aswan. After checking in, another tour awaits, this one featuring a visit to the High Dam that lies across the Nile as one of the world’s largest embankment dams. You’ll visit one of the most important finds in the country, the unfinished obelisk which has provided key insight into ancient stonemasonry methods, and conclude at the Philae temple complex which was built during the Greco-Roman period around 280 BC. The walls contain scenes from Egyptian mythology of Isis bringing Osiris back to life, giving birth to Horus, and mummifying Osiris after death.

- Day 7

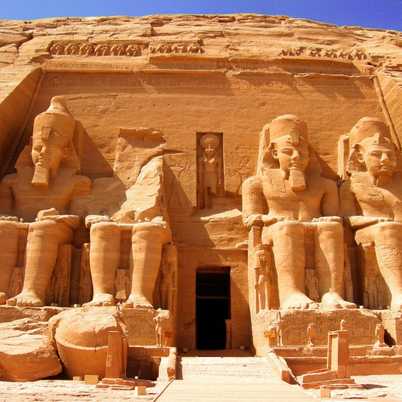

Aswan: Free Day. Optional Abu Simbel Tour

The final day of your trip can be enjoyed on your own, perhaps enjoying the facilities at your hotel, exploring Aswan, or joining an optional tour of Abu Simbel. On the final full day of your trip, you can relax at your hotel, enjoy Aswan at your leisure, or take an optional tour of Abu Simbel. Set along Lake Nasser’s western bank, the ancient temple complex dates to the 13th century BC and includes two massive rock-cut temples, widely considered to be the most magnificent built by Ramses II. You’ll be able to enter both to explore the sanctuaries and hieroglyphs inside.

- Day 8

Departure

After a week of exploring Egypt’s ancient heart, it’s time for your adventure to come to an end. Enjoy breakfast and after checking out of your hotel, you’ll be met by your driver for a private transfer to Aswan’s airport. From here, catch your flight to Cairo followed by an international flight to continue your travels or return home. Should you need assistance, at any point, please reach out to our dedicated staff. Otherwise, we wish you a safe journey and hope to host you on another memorable trip in the future.

Let’s make this itinerary yours.

Speak to our experienced Destinations Experts about designing this itinerary around your budget and needs

COPYRIGHT © 2024 UNFORGETTABLE TRAVEL. ALL RIGHTS RESERVED